Why The 15-Year Car Loan Doesn’t Make Sense

Nov 17, 2025Maybe you saw the satire last week, making the case for the 15-year auto loan alongside the Trump Administration’s push for a 50-year mortgage. To be clear, there doesn’t appear to be any real legs to this idea, but it does present an opportunity to explore why such a product would be a bad idea.

You might ask, why not? As the country looks for ways to deal with inflation, some suggest longer loan terms would be strong medicine for lowering monthly payments on big purchases like homes and cars. This would certainly be the case for the 50-year mortgage or a 15-year auto loan. While both ideas seem rather extreme, the auto loan seems particularly disastrous. Let’s take a look at some basic borrowing rules to see why a 15-year car loan just doesn’t make sense.

Rule #1: Don’t borrow beyond the useful life of the product.

The usual advice when borrowing money is to make sure the loan term doesn’t exceed the item’s useful life, especially if it loses value over time. This rule of thumb doesn’t apply only to auto loans; it should be considered when making other expensive purchases, like furniture, equipment, or flooring. You don’t want to be in the situation where you are making monthly payments on an item you no longer use or own.

What is the useful life of a car? That depends a lot on the car's make / model, as well as the owner's temperament. If you purchase a Toyota and drive it until it reaches 350,000 miles, you could make the case for a longer-term loan. However, statistically, this is an exception, and not the rule. S&P Global Mobility says the average car on the road lasts 12.8 years, meaning a significant number of cars never even reach 10 years. That is 30% sooner than a 15-year term.

Rule #2: Stay ahead of the depreciation curve.

When you borrow to purchase a depreciating asset, you need to consider the asset's depreciation curve. If the useful life of a car is 10 years, you can expect the value of the car to depreciate to a few thousand dollars by the 10th year. This becomes a significant problem on longer-term loans, as you will likely end up with “negative equity” when it comes time to dispose of (or trade in) the car.

Maybe you’ve experienced the scenario where you still owed more than the car was worth when you decided to get your next car. You only have two options when confronted with this problem: continue making payments on a car you no longer own, or roll the negative position into the next car loan. Both are very unfavorable options.

To stay ahead of the depreciation curve, you have a few options. You can reduce the loan term (3-5 years) and make a significant (>20%) down payment on the vehicle at the time of purchase. By staying ahead of the depreciation curve, you will be able to dispose of the car at will and not be required to pay for something you no longer own or use.

Rule #3: Buy used with cash.

The best rule for vehicle purchases is to buy used with cash. Even if you purchase a vehicle that is 2-3 years old, you will likely retain the benefits of the factory warranty without suffering the impacts of depreciation the moment you drive the new car off the lot. The time you hold the car is completely within your control, and there is no negative equity to manage after disposal. By paying cash, you will also not be paying for years (and even decades) of interest beyond the sticker price of the car.

The 15-Year Car Loan Example

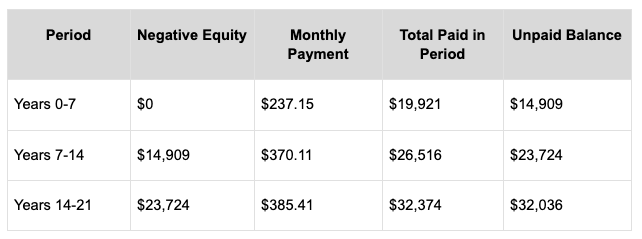

Let’s look at a 15-year car loan example and run the numbers. Let’s assume you buy three cars over 21 years, keeping each vehicle for 7 years before buying the next. We will assume each car costs $30,000 and ignore inflation to keep things simple.

In this example, you take out a 15-year loan for each car. After 7 years, when you trade in your car, you roll that unpaid amount into the next 15-year loan. Even if the dealer gives you $5,000 for your trade-in, you’ll still have to add the leftover debt to your next loan.

Here’s what happens. After 21 years of payments, you’ll have paid $78,811 for $90,000 worth of cars. Even while your monthly payments continue to grow, your unpaid balance balloons to a staggering $32,036.

Conclusion

God’s Word is certainly not silent on the idea of borrowing and debt. While it is never presented as a sin by itself, it does warn us of the burden that borrowing creates. Proverbs 22:7 says, “The rich rules over the poor, and the borrower is the slave of the lender.” While the 15-year car loan is a bit extreme, the principles of borrowing remain the same and offer us an excellent reminder of why we should always seek to keep borrowing terms low and down payments as high as possible. The best scenario is to save your money and then pay cash for a 2-3 year-old vehicle. Don’t let a long-term loan enslave your future. If you need help creating a plan to get out of debt, you should seek the help of a trusted financial counselor.

About the author: Nate Sargent holds a Bachelor of Science in Electrical Engineering from Purdue University and an MBA from Colorado State University. He also earned a Certificate in Financial Planning from the Ron Blue Institute at Indiana Wesleyan University and is a Certified Christian Financial Counselor through the Institute for Christian Financial Health. With 25 years of experience in the aerospace industry, Nate brings a passion for solving complex challenges—both technical and financial. He writes and speaks on the intersection of faith and finances, encouraging others to view money not as an end, but as a tool for greater purpose and impact. Learn more about Nate at Christian Money Help.

Are you struggling to overcome money issues? We can help.

Our Christian financial counselors are trained to help you overcome the stress and anxiety of money. Gain clarity, confidence, and peace in your financial situation.